HousingWorks RI Annual Fact Book shows middle income Rhode Islanders struggle with housing costs

HousingWorks RI at RWU releases 10th Annual Housing Fact Book which analyzes trends in housing affordability in Rhode Island

PROVIDENCE, R.I., – The 2014 Housing Fact Book released today by HousingWorks RI at Roger Williams University (HWRI) shows a persistent housing cost burden for Rhode Island homeowners and renters alike, but particularly for the state’s lower and middle income groups. 2014 marks the 10th annual Housing Fact Book and the analysis looks back at trends in housing affordability inRhode Island since 2000.

“Rhode Island’s housing market has changed dramatically during the last decade. From the surging home prices in 2003 to when the bubble burst in 2007 to the lingering effects of the foreclosure crisis today, we wanted to see what this has meant for housing affordability for Rhode Islanders at different income levels,” said Nicole Lagace, Director of HWRI. “Documented throughout our analysis are persistent housing cost burdens for homeowners and renters alike, despite marked highs and lows in home and rent prices over the last decade.”

HWRI ordered Rhode Island homeowner households by income and then divided them into five equally sized groups. The analysis isolated thechanges in household income and spending on housing costs for the lowest income, middle income and highest income homeowners.

“We found that spending on housing outpaced incomes for homeowners at all income levels from 2000 to 2012,” said Jessica Cigna, Research and Policy Director for HWRI. “But more troubling was that Rhode Island’s lowest and middle income homeowners saw a decline in their incomes. It’s no surprise then to see that since 2000 the percent of cost burdened households has grown by 14 percent for the lowest income homeowners, and by 53 percent for middle income homeowners.”

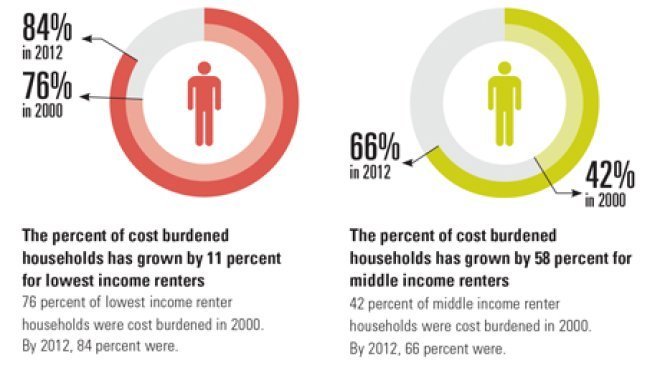

HWRI did a similar analysis for the state’s rental market and found that spending on housing grew for all renter households in Rhode Island between 2000 and 2012. Rhode Island’s lowest income renter householdsexperienced a 20 percent increase in spending on housing at the same time their incomes decreased by 4 percent. Middle income renters saw a 17 percent increase in spending on housing and a 3 percent decline in their incomes.

“We’re concerned to see spending on housing outpace the incomes of the state’s middle class because we know it is linked to growth in the number of households who are housing cost burdened,” Lagace said. “When households are spending more than 30 percent of their gross annual income on housing, they have decreased purchasing power and can not fully participate in their local economy.”

HWRI measured the decreased purchasing power of cost burdened homeowner and renter householdsfrom the three lowest income groups in Rhode Island. High housing cost burdens decrease the purchasing power of over 130,000 Rhode Island households and restrict their ability to diversify their spending in our local economy. HousingWorks RI analysis estimates this figure at $927 million annually.

“Imagine if that money was diversified through the state’s economy rather than being tied up in high housing costs. What would that mean for local businesses,” suggested Lagace. “Certainly, the decreased purchasing power that results from housing cost burdens must be considered as we discuss ways to strengthen the middle class and grow the state’s economy.”

Q2 2014 Foreclosure Report

The 2014 Housing Fact Book also includes HWRI’s Q2 2014 Foreclosure Report. Updated figures show there was a 5 percent increase in foreclosure deed filings in the first half of 2014 compared to the prior year. Looking just at the second quarter, foreclosure deed filings declined from 412 in 2013 to 377 in 2014.

Locally, twenty-one communities had an increase in foreclosure deed filings in the first half of 2014 when compared to 2013. Thirteen communities and the East Side of Providence reported decreases. Five communities saw no change at all.

During Q2 of 2014 Rhode Island was 3rd in New England and 9th in the nation for percent of seriously delinquent loans. At 6.25 percent Rhode Island surpassed the national figure of 4.80 percent.