HousingWorks, Women's Fund Infographic: More Older Women in R.I. Burdened by Housing Costs

More senior women “heads of households” own their homes today than in 2000, but for those with a mortgage, the cost burden is high.

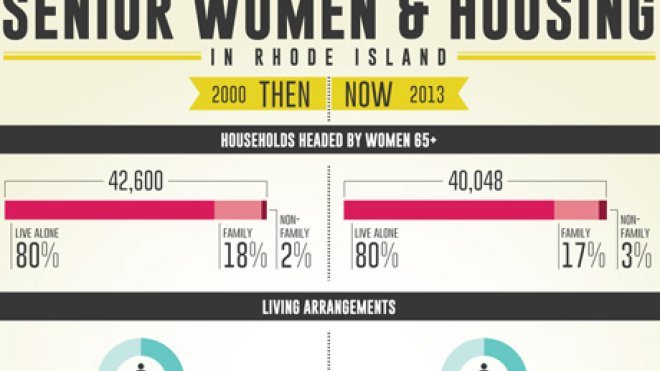

PROVIDENCE, R.I. -- More senior women “heads of households” own their homes today, but for those with a mortgage, the cost burden is high. A new infographic released today by HousingWorks RI at Roger Williams University (HWRI) and the Women’s Fund of Rhode Island offers a glimpse at Rhode Island households headed by women aged 65+.

“We’ve looked at the challenges facing women heads of household in Rhode Island, but this is our first look at how things differ for older women,” said HWRI Director Nicole Lagace. “Given that Rhode Island ranks seventh in the country for the number of women aged 65+, and first for women aged 85+, we wanted to see how the housing picture has changed for older women from 2000 to now.”

HWRI’s analysis of U.S. Census data shows that more senior women “heads of household” own their own homes today than in 2000. For those women who own their homes and have a mortgage, 62 percent are burdened by their housing costs.

“It’s troubling to see that a majority of these mortgaged households are spending more than 30 percent of their income on housing,” Lagace said. “The data also shows us that over a third of these households are severely cost burdened, meaning they spend more than half of their income on housing costs.”

The largest jump in cost burdens occurred for senior women who own their homes, but do not have a mortgage. 29 percent of these homeowners were burdened by housing costs in 2000 compared to 47 percent in 2013. In 2000, the adjusted median income for these homeowners was $26,267 compared to $27,708 in 2013.

“We are especially concerned for this group of women because they saw very little income growth from 2000 to 2013,” said Arianne Corrente, Women’s Fund of Rhode Island policy committee chair and vice chair of the board of directors. “When income doesn’t keep pace with housing costs, it makes it difficult for these older women to fully participate in their local economy and contribute to our state’s wellbeing.”

The infographic also looked at renter households headed by women aged 65+. This group saw a 28 percent increase in those that are housing cost burdened despite a 30 percent increase in median income from 2000 to 2013.

“These findings should serve as a reminder that policymakers must have an integrated approach to improving housing affordability in order to support a wide range of housing options for those across the age spectrum,” Corrente said. “Rhode Island has a growing older population and we know from previous studies that the housing cost burden is a concern for older women seeking to maintain their independence. Achieving economic security is essential to aging in place with dignity.”